FPC is widely used in communications, consumer electronics, automotive electronics, industrial, military, aerospace, and other fields, and its market demand is closely related to the demand for downstream terminal electronics. From the FPC industry, downstream main application structure, according to Primark data, the global FPC output value in 2019 is mainly concentrated in the field of communication electronics and computers, with communication electronics accounting for 33.0% of the score and computers accounting for 28.6%, with consumer electronics, mainly cell phones, constituting the main contribution point of the FPC output value scale. With the release of communication electronics, electric vehicles, wearable devices, and other consumer electronics, the market demand for FPC will gradually rise. According to the data of Huajing Industry Research Institute, the global FPC market size was about USD 13.8 billion in 2019, and it is estimated that the global FPC market size will reach USD 28.7 billion in 2025, with a 6-year CAGR of 13.0%.

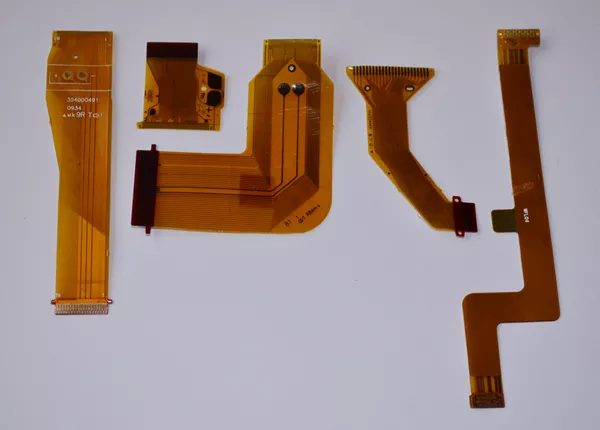

The application of FPC in smartphones involves multi-functional modules such as display, battery, touch, connection, camera, etc. Generally speaking, a smartphone needs about 10-15 pieces of FPC. According to IDC data, global smartphone shipments have declined from 2017 to 2020, with 1.355 billion units shipped in 2021 and 1.31 billion units expected in 2022. Smartphone shipments in China follow the same trend as the global market, with 310 million units expected to be shipped in 2022. However, with the development of innovative smartphone application technologies, the popularization of 5G communication technology, camera module upgrades, under-screen fingerprint recognition, OLED screen, folding screen, and other emerging technologies in smartphones continue to deepen, which is expected to boost the demand for smartphone shipments and create new growth points for the development of FPC in the smartphone field.

In 2019, Samsung, Huawei, Xiaomi, and other cell phone manufacturers launched various models of folding screen cell phones; with the folding screen cell phone industry chain becoming more mature, the global and domestic folding screen cell phone shipments are expected to show a rapid growth trend, according to Media data. According to Media data, global folding screen cell phone shipments are expected to reach 51 million units in 2025; domestically, folding screen cell phone shipments are expected to reach 13.8 million units in 2025, and the rebound in cell phone market demand brought by folding screen technology is expected to continue to drive FPC demand growth.

The rise of the emerging market of wearable devices will boost the expansion of the new incremental market of FPC. In recent years, consumer upgrading and AI and other technologies gradually popularized TWS headphones, VR/AR, smart watches/bracelets, and other emerging consumer electronics smart wearable devices to develop rapidly. According to IDC data, from 2014 to 2021, global wearable device shipments are rising year by year, and the global wearable device shipments will be 534 million units in 2021, up 19.99% year on year. FPC is the preferred connection device for wearable devices because it is thin, light, and bendable, has the highest degree of fit with wearable devices, and will be one of the biggest beneficiaries of the booming market of wearable devices.

The VR/AR headset device market has exploded, promoting the increase in FPC usage. Currently, the FPC usage of AR/VR devices can range from 10 to 20 for common models to mid- to high-end models, and some high-end models may use more than 20 FPCs due to more sensors, complex circuits, and more stringent requirements for product weight and performance. In the future, as the product iterations are upgraded, the functions are enriched, more sensors and cameras are introduced, and the product requirements for lightweight and heat dissipation are enhanced, the number of FPCs will be further increased. Global AR/VR market shipments are expected to grow from 5.85 million units in 2020 to 21.3 million units in 2024, with a CAGR of 29.49%. China’s VR device shipments are on an overall growth trend, with 1.69 million units in 2021 and 12.66 million units expected in 2025, with huge market potential for FPC as an important component of VR/AR.

If you’re looking for the best quality FPCB fabrication company, look no further than Anpllopcb. Our pricing is competitive, and our speed can’t be beaten. Get a quote for FPCB fabrication now.